A cryptocurrency is a digital currency that is self-organized, whose value is determined mainly by social consensus. In addition to being decentralized, a cryptocurrency is not backed by any third party or central bank. Essentially, cryptocurrencies are limited entries in a database, not controlled by anyone but by the network itself, which is unchangeable unless specific conditions are fulfilled. All these conditions make cryptocurrency prices unpredictable and constantly fluctuating.

Cryptocurrency trend prediction

Problem

In the last decade, the stock market and finance industry attracted many researchers and analysts and placed it under scrutiny, trying to achieve a reliable accuracy in predicting the market movements and price ranges. However, when applied to cryptocurrencies, even the most tuned single-variate forecasting models fail to deliver consistent performance and may fail terribly in making good crypto-market speculations.

· The price of Bitcoin suddenly rose to almost $20,000 and then dropped to $6,000. Due to such incidents, it is complicated for the investors to trust the ecosystem.

· Liquidation of cryptocurrencies takes time and is not exactly simple. Therefore, investors can lose thousands of dollars before they sell the currency.

· Classic forecasting methods are not effective with cryptocurrencies due to their vulnerabilities towards unforeseen events and the importance of human factor.

· People with no knowledge in how cryptocurrencies work and how to assess values may lose a lot when venturing in the crypto market.

Our Solution

We at YAIGLOBAL, have taken this challenging problem and thoroughly studied different approaches and benchmarking described by other researchers and scholars who invested time and effort in the field of AI-assisted trading. We have managed to skip the less efficient incomplete classical methods and jump right in the state-of-the-art AI race.

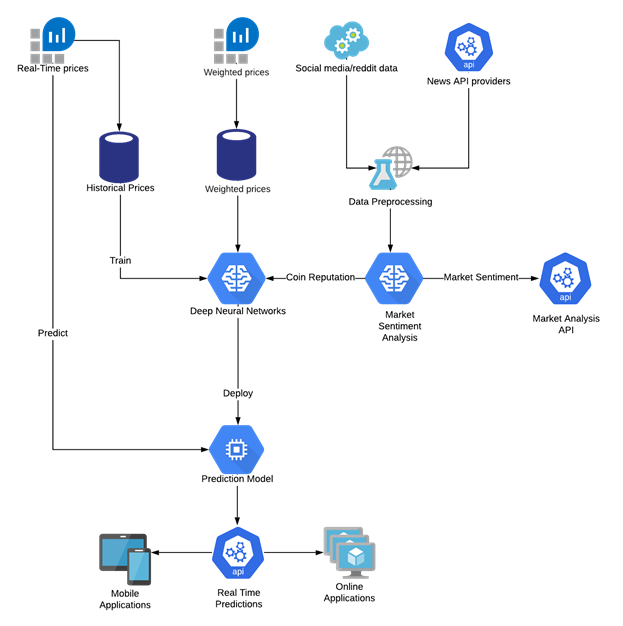

Our solution is an Artificial Intelligence capable of predicting the price and market movement direction of cryptocurrencies using top of the line Deep Learning and NLP technologies.

Combining the power of Recurrent Neural Networks in detecting unusual and non-seasonal time-series patterns, and the latest Natural Language Processing and sentiment analysis technologies. Our models integrate the non-quantifiable features and raw, unexploited data like social media and news articles to enhance the standard financial prediction methods and elaborate a more accurate, consistent forecasting.

Technical approach

To breakdown our solution we can divide it into major areas

I. Historical prices model:

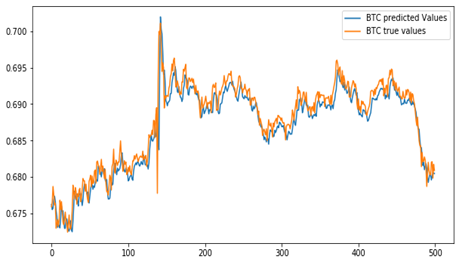

We used all recorded historical prices data points to train an LSTM (Long Short-Term Memory) based neural network that can detect the price dependencies across previous data points. LSTMs are an evolution of RNN (Recurrent Neural Networks). They are capable of learning long-term dependencies and remembering information for prolonged periods of time as a default, which makes them optimal for forecasting prices timeseries.

We introduced different cryptocurrency indicators and stats to enhance the model like circulating volume, weighted prices, market cap and daily trading numbers.

We have optimized and tuned our model to reach very small error rates and have a better generalization over the time. The model’s accuracy was validated by statistical methods: RMSE, MSE, and MAE.

II. Market sentiment analysis:

For complete market sentiment analysis assessment, we are using news from more than 1150 sources including cryptocurrency forums and subreddits and major crypto trading platforms. In addition, we are using social media posts, comments and daily interactions to get feedback and evaluate the trading fear index. We are using the following steps to implement our sentiment analysis models:

· Data gathering and preprocessing from different sources.

· Data wrangling and aggregation according to source and category.

· Sentiment analysis prediction using an ensemble of pre-trained NLP sentiment analysis models

· Using the output sentiments, we calculate the coin’s reputation and the overall market sentiment for the wanted time window.

· Our model outputs the different calculated signals using an API endpoint that can be used either in standalone or as input for other models.

III. Prediction model

The prediction model is the final model combining the previous 2 models, and it uses live real-time price feed and outputs from the sentiment analysis model to forecast the price and market movement for the next time-window. This model is trained using historical data, cryptocurrency indicators, news and social media interactions. It uses online training for continuous learning with live stream data.

This model has the advantage of adapting dynamically and optimally without requiring complete re-learning each time new input data are processed.

Figure 1 Basic Architecture of Our Solution

Figure 2 Real vs Predicted prices of the last 500 BTC intraday prices

Conclusions and recommendations

AI-aided solutions are currently used in a broad range of industries from healthcare to finance making smarter safer data driven decisions. Our models can have multiple uses cases ranging from helping the end user with their everyday cryptocurrency use, to more advanced trading platforms/experts making use of the different signals we can provide with our endpoints.

Our models provide different API endpoints:

· Real time price predictions and market movement

· Real time market sentiment analysis (news, articles, social media)

· Trading fear index (under development)

· Coin correlations and dependencies (under development)

We are currently in the process of deploying our models on AWS for a faster more responsive performance, reducing the latency between different API endpoints and making use of the giant’s immense computing power. Our models are continuously maintained and optimized to match the different market changes and sudden events.

Cryptocurrency price prediction is a very tricky task and it can have some limits such as:

· Market corrections

· Big whales liquidating currencies

· Human factor and unforeseen events